Hexagram 12 “Standstill”

Market Stagnation

Heaven(☰) above, Earth(☷) below

When markets stagnate, so should your activity—don’t force trades.

Hexagram 12 in the I Ching represents Stagnation or Standstill. It symbolizes a period of blockage, lack of progress, and unfavorable conditions.

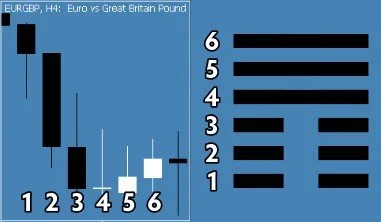

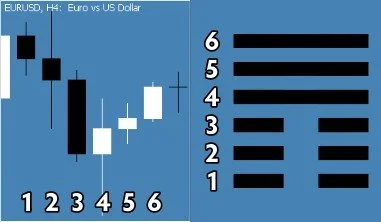

Examples of how Hexagram 12 can appear in four-hour charts:

In the context of forex trading, this hexagram can be interpreted as follows:

Key Themes of Hexagram 12 in Forex:

Market Stagnation:

Hexagram 12 suggests a period of stagnation or lack of progress in the market. In forex, this could mean a range-bound market with little to no clear trend, low volatility, and limited trading opportunities.

Traders may find it challenging to identify high-probability setups, as the market may be moving sideways without clear direction.

Patience and Caution:

The hexagram emphasizes the importance of patience and caution during periods of stagnation. In forex, this means avoiding impulsive trades and waiting for clearer, more reliable opportunities.

Focus on preserving capital and avoiding unnecessary risks during this phase.

Risk Management:

Hexagram 12 underscores the need for careful risk management. In forex, this means setting tight stop-loss orders, managing position sizes, and avoiding overleveraging.

Be prepared for potential sudden market movements and ensure that your risk management strategy is robust.

Preparation and Analysis:

The hexagram encourages preparation and thorough analysis during periods of stagnation. In forex, this means using the time to analyze the market, refine your strategies, and prepare for potential breakouts or trends.

Keep an eye on key support and resistance levels, economic news, and other factors that could influence market movements.

Avoiding Unnecessary Risks:

Hexagram 12 warns against engaging in unnecessary risks or conflicts. In forex, this means avoiding trades with low probability or high uncertainty.

Stick to your trading plan and only enter trades that meet your predefined criteria, even if it means sitting out during periods of stagnation.

Practical Forex Interpretation:

Range-Bound Market: Hexagram 12 indicates a market that may be experiencing stagnation or a lack of clear direction. Focus on identifying key levels and waiting for clearer signals before entering trades.

Patience and Caution: Be patient and avoid impulsive trades. Wait for clearer, more reliable opportunities before entering the market.

Risk Management: Prioritize risk management by setting tight stop-loss orders and managing position sizes to protect your capital during stagnant market conditions.

Preparation and Analysis: Use the time to analyze the market, refine your strategies, and prepare for potential breakouts or trends. Consider using tools like moving averages, RSI, and Fibonacci retracements to identify key levels and confirm trade setups.

Avoiding Unnecessary Risks: Avoid trades with low probability or high uncertainty. Stick to your trading plan and only enter trades that meet your predefined criteria.

Cautionary Note:

Hexagram 12 warns against forcing action during periods of stagnation. In forex, this means avoiding the temptation to trade frequently or chase after uncertain setups. Instead, focus on preserving capital and waiting for clearer opportunities.

In summary, Hexagram 12 in the context of forex trading suggests a period of stagnation and limited trading opportunities. It encourages patience, caution, and careful risk management. Traders should focus on preserving capital, analyzing the market, and preparing for future opportunities. By maintaining discipline and avoiding unnecessary risks, traders can navigate the challenges of this phase and position themselves for future success.

Affirmation: "Stillness is part of the cycle; I embrace it."