Hexagram 41 “Decrease”

The Art of Subtraction

Mountain(☶) above, Lake(☱) below

Cutting losses is wisdom, not weakness—preserve capital.

Hexagram 41 in the I Ching represents Decrease or Diminishment. It symbolizes the need to let go, reduce excess, and focus on what is essential.

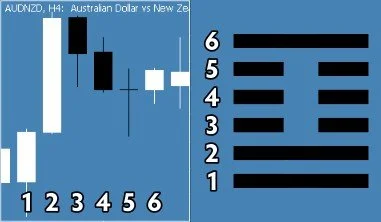

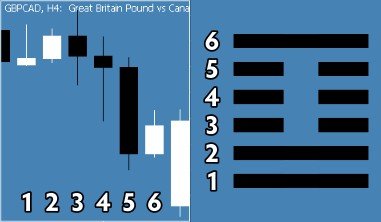

Examples of how Hexagram 41 can appear in four-hour charts:

In the context of forex trading, this hexagram can be interpreted as follows:

Key Themes of Hexagram 41 in Forex:

Reduction and Simplification:

Hexagram 41 emphasizes the importance of reduction and simplification. In forex, this means cutting back on unnecessary trades, reducing complexity in your strategies, and focusing on high-probability setups.

Traders should avoid overtrading or overcomplicating their approach, as this can lead to unnecessary losses.

Letting Go of Excess:

The hexagram highlights the value of letting go of excess. In forex, this means being willing to exit losing trades, abandon ineffective strategies, and cut losses when necessary.

Focus on preserving capital and avoiding unnecessary risks.

Risk Management:

While the hexagram encourages reduction and simplification, it also underscores the importance of managing risk. In forex, this means setting stop-loss orders, managing position sizes, and avoiding overleveraging.

Be prepared for potential market volatility and ensure that your risk management strategy is robust.

Patience and Discipline:

Hexagram 41 also suggests the need for patience and discipline. In forex, this means waiting for the right opportunities and not rushing into trades based on incomplete or ambiguous information.

Focus on maintaining a disciplined approach to trading and sticking to your trading plan.

Focus on Essentials:

The hexagram encourages focusing on what is essential. In forex, this means prioritizing key indicators, reliable strategies, and well-understood setups.

Avoid getting distracted by market noise or uncertain opportunities; instead, stay focused on clear and reliable signals.

Practical Forex Interpretation:

Reduction and Simplification: Cut back on unnecessary trades and reduce complexity in your strategies. Focus on high-probability setups and avoid overtrading or overcomplicating your approach.

Letting Go of Excess: Be willing to exit losing trades, abandon ineffective strategies, and cut losses when necessary. Focus on preserving capital and avoiding unnecessary risks.

Risk Management: Prioritize risk management by setting stop-loss orders and managing position sizes to protect your capital during volatile market conditions.

Patience and Discipline: Wait for the right opportunities and maintain a disciplined approach to trading. Avoid impulsive decisions and focus on high-probability setups.

Focus on Essentials: Prioritize key indicators, reliable strategies, and well-understood setups. Avoid getting distracted by market noise or uncertain opportunities.

Cautionary Note:

Hexagram 41 warns against clinging to excess or unnecessary complexity. In forex, this means avoiding the temptation to take on excessive risk or deviate from your trading plan. Stay disciplined and ensure that your trades are based on solid analysis and reasoning.

In summary, Hexagram 41 in the context of forex trading suggests a period of reduction, simplification, and focusing on what is essential. It encourages traders to cut back on unnecessary trades, prioritize risk management, and maintain a disciplined approach. By focusing on high-probability setups and preserving capital, traders can navigate the market effectively and achieve long-term success.

Affirmation: "By doing less, I achieve more."