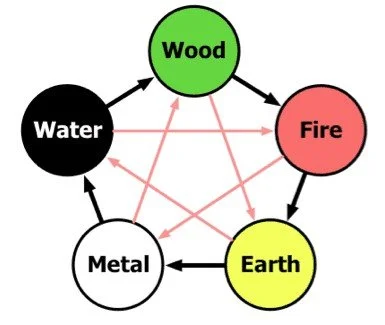

Trading with the 5 Elements

Depending on where you’re from, you may be familiar with the concept of classical elements, 4 of 5 in number—Taoism has 5. On this page, we’ll merge Taoist philosophy with forex trading through its Five Elements—a framework to identify trends, reversals, and chaos. No mystical jargon, just actionable strategies. This is your 5-element toolkit to read markets holistically.

The 5 Elements Demystified

Imagine the market as nature’s cycles—growth, peaks, stability, collapse, and unpredictability. That’s the Five Elements in a nutshell. Let’s break them down how they express themselves on a chart:

1. 🌳 WOOD (Growth)

Like a tree growing steadily—it resembles bullish trends with pullbacks (e.g., AUD/USD in a commodity boom).

Candlestick Patterns that express Wood energy:

Three White Soldiers (strong bullish continuation)

Bullish Engulfing (reversal after a pullback)

2. 🔥 FIRE (Overextension)

Visualize a bonfire burning too bright—it resembles parabolic rallies that often reverse (e.g., Bitcoin manias).

Candlestick Patterns that express Fire energy:

Dragonfly Doji (reversal after a sell-off)

Marubozu (strong, no-wick candles showing conviction)

3. ⛰️ EARTH (Stability)

Like flat plains between mountains—it resembles sideways markets and periods of consolidation (e.g., EUR/CHF in quiet periods).

Candlestick Patterns that express Earth energy:

Doji / Spinning Top (indecision, potential reversal)

Inside Bar Breakout (consolidation before a move)

4. ⚔️ METAL (Collapse)

Visualize a sword slicing down—it resembles sharp downtrends (e.g., USD/JPY during Fed hikes).

Candlestick Patterns that express Metal energy:

Pin Bar Rejections (precision entry at key levels)

Evening Star / Morning Star (trend reversal signals)

5. 🌊 WATER (Chaos)

Like a stormy river—it resembles the activity you see during news-driven chaos (e.g., GBP crashes during Brexit)."

Candlestick Patterns that express Water energy:

Falling/ Rising Three Methods (continuation patterns)

Long Wick Rejections (signaling potential reversals in flow)

Practical Trading Strategies

Now, let’s pair these elements with tools that you may already use:

1. Wood (Growth, Expansion, Momentum)

Practical Strategies:

Fibonacci Expansion + Wood Energy:

Use Fibonacci extensions (161.8%, 261.8%) to identify where strong momentum (Wood) may continue.

Look for breakouts in ascending channels or after bullish flag patterns.

2. Fire (Volatility, Energy, Rapid Moves)

Practical Strategies:

Fibonacci Retracement + Fire Energy:

Trade sharp pullbacks (38.2% or 50%) in strong trends, expecting explosive continuation.

Use volatility indicators (ATR, Bollinger Bands) to gauge Fire’s intensity.

3. Earth (Stability, Consolidation, Balance)

Practical Strategies:

Fibonacci Support/Resistance + Earth Energy:

Trade ranges (between 38.2% - 61.8%) in sideways markets.

Use moving averages (50 EMA, 200 SMA) as dynamic support/resistance.

4. Metal (Precision, Structure, Discipline)

Practical Strategies:

Fibonacci Confluence + Metal Energy:

Look for 61.8% retracements + trendline bounces for high-probability entries.

Use harmonic patterns (Gartley, Bat) for structured reversals.

5. Water (Flow, Adaptability, Trend Following)

Practical Strategies:

Fibonacci Trend Continuation + Water Energy:

Trade impulsive waves with Fibonacci channels for trend alignment.

Use MACD/RSI divergence to spot trend exhaustion.

Risk Management

Does the chart have a Wood/Metal vibe? Go big (1-2% risk).

Does the chart have a Fire/Water vibe? Go small (0.5% risk).

Mindset & Adaptation

Taoism teaches Wu Wei, which means “effortless action.” trading:

Wood: Patience (wait for setups). Patience in Trends: Wood grows steadily—avoid overtrading; let winners run.

Flexibility: If momentum stalls (e.g., long upper wicks), consider partial profits.

Fire: Discipline (don’t chase). Quick Decision-Making: Fire moves fast—set tight stops and take swift action.

Emotional Control: Avoid revenge trading after sudden reversals.

Earth: Endurance (stability in one’s positions) Discipline in Choppy Markets: Earth is slow—avoid forcing trades in unclear conditions.

Adaptability: Shift to range-bound strategies when trends weaken.

Metal: Precision (cut profits quickly)Mechanical Execution: Metal is rigid—stick to the plan without emotional deviation.

Risk Management: Tight stops, high reward-to-risk setups only.

Water: Adaptation (switch strategies fast). Go with the Flow: Water doesn’t fight the trend—trade in the dominant direction.

Adapt to Market Shifts: If the trend weakens, switch to Earth/Metal strategies.

Final Integration: The 5-Element Trading Cycle

Wood (Breakout) → Fire (Momentum) → Earth (Consolidation) → Metal (Reversal/Structure) → Water (New Trend)

Have you observed these cycles on the charts? Adapt your strategy based on which "phase" the market is in.